How to Use Alipay Without a Chinese Bank Card

For travelers visiting Beijing or other Chinese cities, cashless payments via Alipay are ubiquitous in daily life—from street food stalls and taxis to luxury restaurants and shopping malls. The good news is you don’t need a Chinese bank card to use Alipay. This guide walks you through its setup process, payment methods, money-saving tips, and…

For travelers visiting Beijing or other Chinese cities, cashless payments via Alipay are ubiquitous in daily life—from street food stalls and taxis to luxury restaurants and shopping malls. The good news is you don’t need a Chinese bank card to use Alipay. This guide walks you through its setup process, payment methods, money-saving tips, and common fixes, tailored specifically for Western travelers.

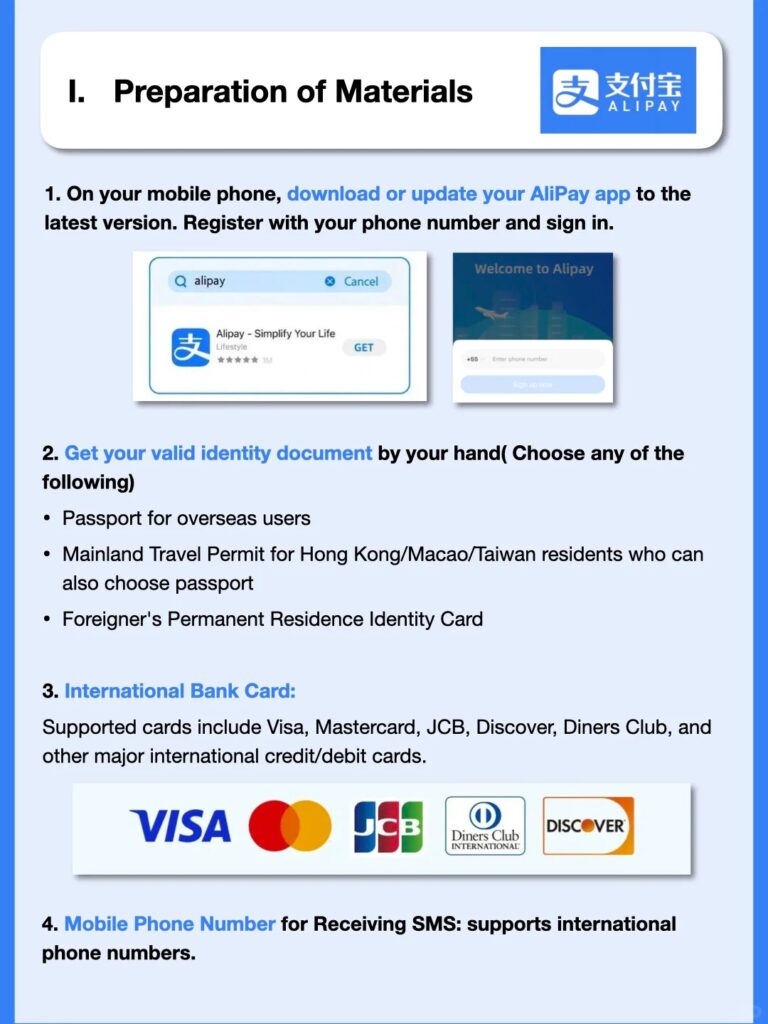

1. Key Preparation Before Setup

First, ensure you have the basics ready to avoid delays during setup:

- A valid international phone number (you can use your home number to register).

- An international credit/debit card (Visa, Mastercard, American Express, Diners Club, or Discover is supported.

- Your passport (required for identity verification).

- The latest version of Alipay (download from App Store or Google Play).

Pro tip: Set up Alipay 3-5 days before your trip. This gives you enough time to resolve any verification issues and ensures you’re ready to pay as soon as you arrive in China.

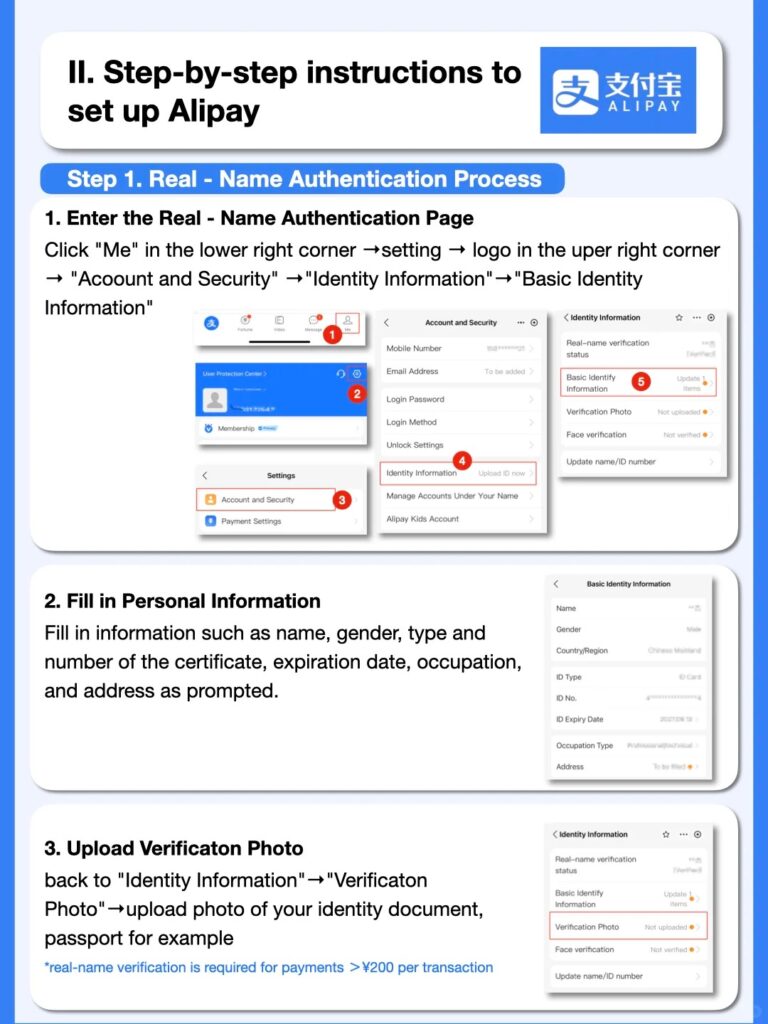

2. Step-by-Step Setup for Alipay

Alipay’s international version is designed with foreign users in mind, featuring multi-language support and a user-friendly interface. Here’s how to activate its payment function:

1. Download Alipay and register with your international phone number. Select the “International Version” at login to access English instructions—Alipay also supports 14 other languages, like Spanish, French, and German, for added convenience.

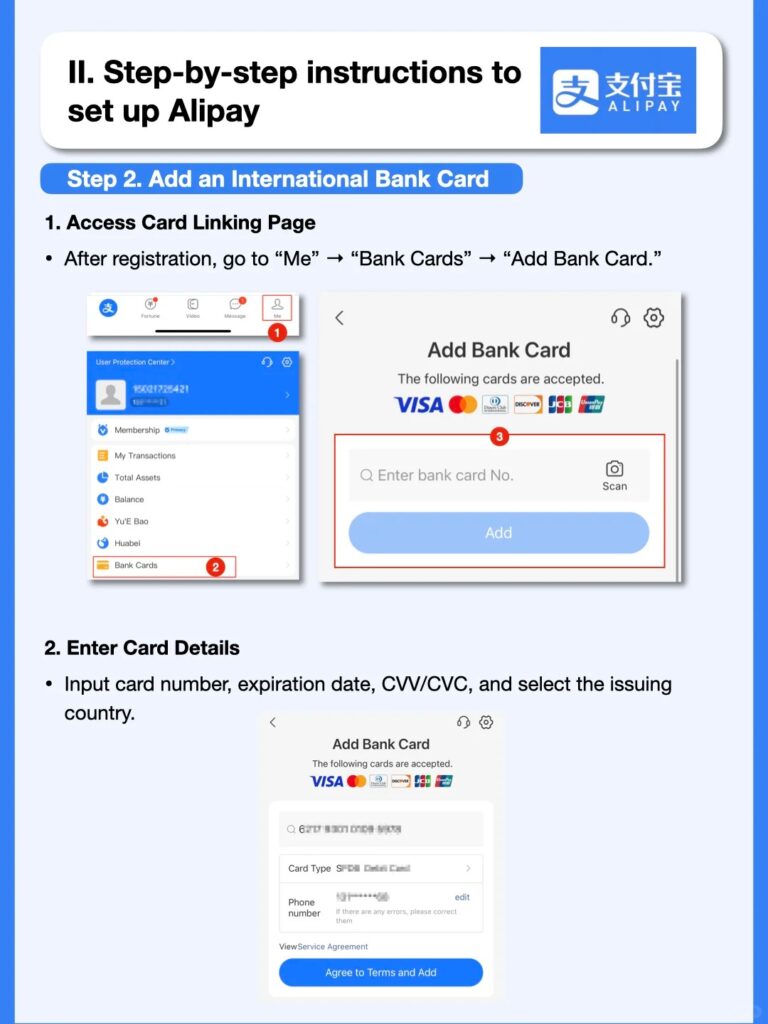

2. On the homepage, tap “Add Debit or Credit Card”. If this option isn’t visible, navigate to “Me” > “Bank Cards” to find the card-adding function.

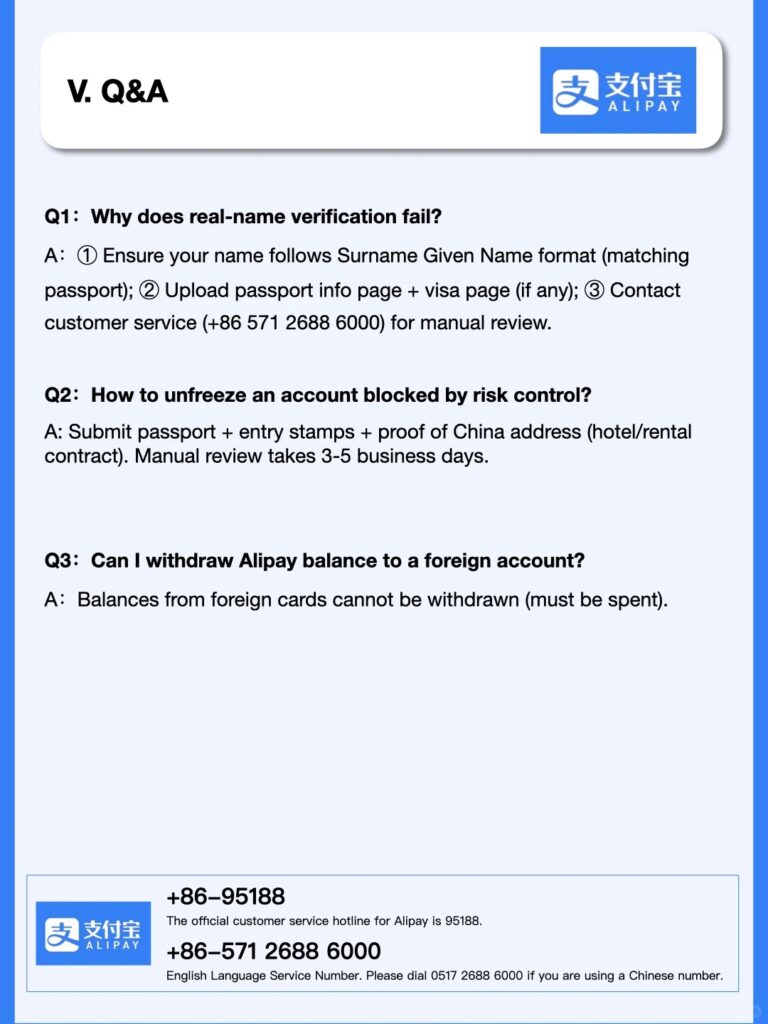

3. Enter your card information (card number, expiry date, CVV code) and complete identity verification. Simply match your full name to your passport—no additional address details are needed for most cases.

4. Confirm the binding via SMS verification from your bank. Once done, your Alipay is ready for use at millions of merchants across China.

Bonus: Alipay+ allows you to use your home e-wallet (if it’s a partner) to scan merchant QR codes directly, skipping the app setup process entirely for short trips. Look for the Alipay+ logo at checkout counters.

3. How to Make Payments with Alipay

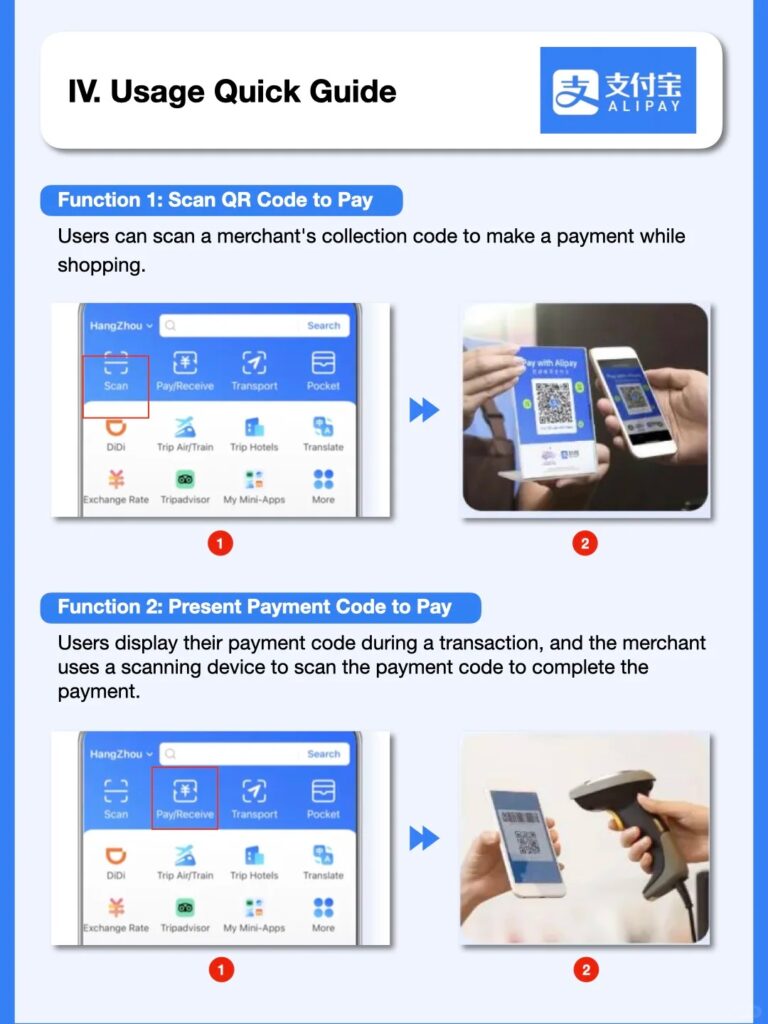

Alipay uses QR codes for transactions, and the process is simple for both scenarios:

– Merchant scans your code: Open Alipay, tap the “Pay” icon on the homepage to display your personal QR code. The merchant will scan it, and the amount will be deducted from your international card automatically.

– You scan the merchant’s code: Use Alipay’s “Scan” function to read the merchant’s QR code, enter the payment amount manually, and confirm the payment.

Note: Alipay can also be used for taxi rides, public transport, hotel bookings, and even ticket purchases in Beijing, making it a one-stop tool for your trip.

4. Fees, Limits, and Money-Saving Tips

Understanding Alipay’s fee rules and limits helps you avoid unexpected costs:

– Fees: Transactions under 200 RMB are fee-free. For amounts over 200 RMB, a 3% international transaction fee applies. Ask merchants to split large purchases into smaller transactions to waive this fee.

– Limits: The single transaction limit is up to 3,000 RMB (or ~500 USD), with an annual cap of 50,000 USD—more than sufficient for most travelers’ daily expenses in Beijing.

– Exchange rates: Rates are set by your bank or card issuer. Check your card’s international transaction policy beforehand to choose the one with favorable rates.

5. Common Issues and Fixes

Even with successful setup, you may encounter small hurdles. Here’s how to resolve them quickly:

– Payment failed: Contact your bank to unblock cross-border payments—some banks restrict transactions in China by default. Also, ensure your card is within its expiry date and has sufficient balance.

– Merchant refuses foreign-linked cards: Small vendors or local markets may prefer cash due to higher fees for international transactions. Keep 500-1,000 RMB in cash as a backup, especially in non-tourist areas.

6. Final Recommendations for Beijing Travelers

Maximize your Alipay experience in Beijing with these tips:

– Alipay is widely accepted in central Beijing’s hotspots, including Wangfujing, Sanlitun, and airport/hotel areas. It’s also compatible with most chain restaurants and convenience stores.

– Use Alipay’s built-in features: The app offers currency conversion tools, nearby food recommendations, and multi-language customer service to assist you during your trip.

– Carry a physical Visa/Mastercard as a backup—some hotels or airports may have temporary app glitches, and a physical card ensures you won’t be stranded.

With this guide, you’ll navigate Beijing’s cashless society smoothly using Alipay—no Chinese bank card required. Enjoy your hassle-free trip!